Preliminary Report to the Concordia Student Union on Concordia’s Investment Practices

November 25, 2013

Erik Chevrier

Preliminary Report to the Concordia Student Union on Concordia’s Investment Practices

Concordia University is an institution that significantly affects economic growth. Concordia has large investments, is responsible for research and innovation, and provides education and job training. The report, Concordia: An Economic Force Connected to its Community Study on the Impact of Concordia University, statesi

“Concordia University makes a major contribution to the economies of Montreal and Quebec. Every year, it generates nearly $1.3 billion in quantifiable benefits, a contribution three times greater than its annual operating expenditures. Few institutions, whether public or private, can boast such a leverage effect. The university’s economic impacts are felt most strongly in three areas […] First, nearly 90,000 Concordia graduates work in Quebec. Their university education contributes to an increase in productivity of $623 million. Furthermore, research conducted and disseminated by the university brings $177 million into the Quebec economy. Lastly, spending by Concordia and by its students and visitors from outside Quebec generates $464 million in value added, resulting in the creation of more than 7,000 jobs. (p. 5)

For decades, influential economists like G.K. Galbraithii have pointed out that economic growth should be focused on areas of the economy that are useful, that promote social and physical well being and that are not harmful to us and/or the biosphere. Galbraith suggests that the quantity of productive outputs is not as important as the quality of what these products bring to society. Concordia agrees with this position.

In the report mentioned previously, it also states, “[…] Concordia’s impacts far exceed these quantifiable elements. Through its integration into the social, economic, cultural and community fabric of Montreal and Quebec, Concordia makes exceptional contributions to enhancing the quality of life and economic potential of Quebec society.” (p. 5)

Concordia’s Commitment to Responsible Environmental Stewardship and Sustainability

Concordia University is “committed to responsible environmental stewardship through all the Universities activities and functionsiii”. This includes the companies that Concordia contractsiv, the companies that Concordia allows to perform their researchv, and the companies that Concordia invests invi.

Concordia’s report, mentioned above, states, “Concordia is committed to leading in sustainability. It has undertaken to raise public awareness and promote innovation to address the issues involved. This initiative is a demonstration of its resolve to democratize access to knowledge and expertise, and to engage the community in dialogue through various events outside the traditional educational framework. Thanks to its many activities, Concordia organizes citizen participation and encourages its employees, professors and students to participate in the many social initiatives offered in its environment. Always dynamic, the university stands out as an engaged and thoroughly engaging institution.” (p. 7)

What kind of economic growth does Concordia participate in? Does Concordia’s commitment to environmental stewardship and sustainability extend to their investment practices? This research report focuses on how Concordia participates in the growth of future commodities by looking at their financial investment practices.

Investments and Growth

In order for economic growth to occur, companies need investments to expand upon and improve their buildings, machines and equipment (constant/fixed capitalvii) and to maintain their day-to-day operations at a higher capacityviii (variable/working capitalix). These investments can be obtained internally, by reinvesting a company’s profits back into their own business and/or externally from banks, governments and share holders. Concordia participates in the growth of various types of industries by investing approximately $120 million from the Concordia Foundation in 2013, $107 million in 2012 and $116 million in 2011 (see Appendix A).

What Types of Industry does the Concordia Foundation Help Grow?

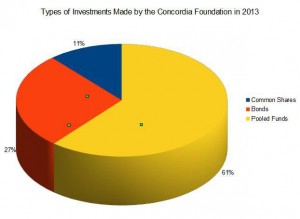

The Concordia foundation holds three types of investments: common shares, bonds and pooled fundsx. Concordia currently holds 61% of its investments in pooled funds, 27% in bonds and 11% in common shares (see Figure 1).

Figure 1

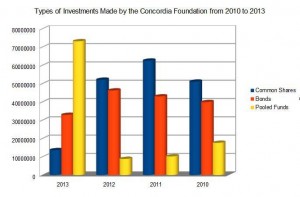

Since 2012, the Concordia Foundation have shifted the majority of their investments from common stocks to pooled funds while keeping their bonds fairly consistent (see Figure 2).

Figure 2

Common Shares

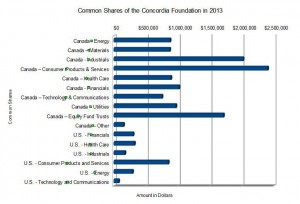

The Concordia Foundation has approximately $13.7 million dollars invested in common shares. The majority of its common shares are invested in Canadian consumer products and services, Canadian industrials and Canadian equity funds. For a complete breakdown of the Concordia Foundation’s common share holdings of 2013, please see Figure 3.

Figure 3

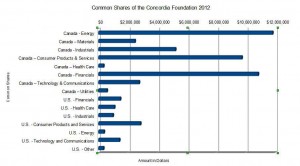

From 2012 to 2013, the Concordia foundation sold approximately $38.5 million dollars of its common shares including approximately $11 million dollars worth of shares in energy, $9 million dollars worth of shares in financials and $7 million dollars worth of shares in communications and media. To see the Concordia Foundation’s common share holdings for 2012, please see Figure 4.

Figure 4

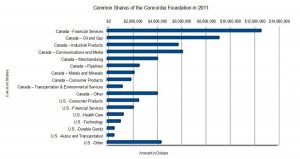

In 2011, the Concordia Foundation reported its common shares in a different manner than in 2012 and 2013. In 2011, the labels oil and gas, pipelines, metals and minerals appear on the financial report instead of energy, materials and utilities. Please see Figure 5 for the Concordia Foundation’s common shares in 2011.

Figure 5

The information in the Concordia Foundation’s financial statements regarding common shares are extremely ambiguous. They do not reveal anything about the specific companies or precise types of economic activity that are receiving the investments – i.e. under energy, we do not know what type of energy forms (renewable or nor renewable) or which company is receiving the investment. Unfortunately, the Concordia Foundation will not release more specific information regarding their investments in common shares.

Bonds

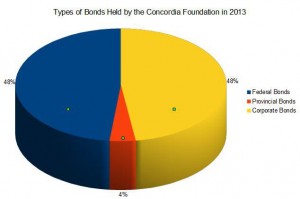

The Concordia Foundation currently invests $33 million dollars in three types of bonds: federal bonds at 1.5% to 4.25%, provincial bonds at 2.9% to 5.75%, and corporate bonds at 2.05% to 12.2% (please see Figure 6).

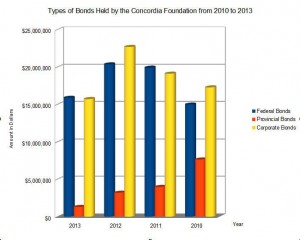

Figure 6

The Concordia Foundation sold $13 million of its bonds between 2012 and 2013. Since 2010 bond holdings have remained fairly constant compared to common shares and pooled funds. Please see Figure 7 for a breakdown of the Concordia Foundation’s bond holdings from 2010 to 2013. The information in the Concordia Foundation’s financial statements regarding corporate bonds are also extremely ambiguous. Again, they do not reveal anything about the specific companies or precise types of industry that are receiving the bonds. Unfortunately, the Concordia Foundation will not release more specific information regarding their investments in corporate bonds.

Figure 7

Pooled Funds

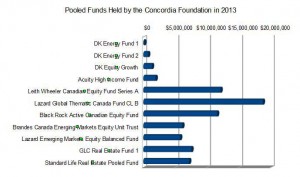

The Concordia Foundation currently invests $73 million dollars in pooled funds. This amount has increased by $64.3 million dollars from 2012 to 2013. To see the types and amounts of investments in pooled funds, please see Figure 8.

Figure 8

The Concordia Foundation uses the following firms to manage its pooled fund portfolios. None of them specialize in socially responsible investments.

- DK Energyxi

- Leith Wheelerxii

- Lazard Global Thematicxiii

- Blackrock Activexiv

- Brandesxv GLC Real Estatexvi

- Standard Life Real Estatexvii

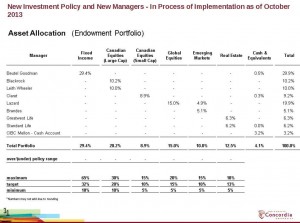

In October 2013, the Concordia Foundation updated the information regarding their pooled funds. Please see Figure 9 for a complete list of pooled funds portfolio managing firms currently contracted by the Concordia Foundation.

Figure 9

The Concordia Foundation also use the following companies to manage their portfolios. These companies also do not specialize in socially responsible investing.

The information in the Concordia Foundation’s financial statements regarding pooled funds are more ambiguous than common shares because the portfolio of a pooled fund changes frequently over time. Once again, the Concordia Foundation will not release more specific information regarding their investments in pooled funds.

Getting Back to the Question, What Types of Industry does the Concordia Foundation Help Grow?

With the information available to us, we cannot answer the question as to what types of industry the Concordia Foundation helps grow. In recap, the Concordia Foundation’s Financial Statements do not give us essential information like the names of companies or details about the industries that receive investments. Mutual funds are hard to track because they vary considerably over time. Furthermore, although requests have been made, the Concordia Foundation will not provide us with more meaningful information about the financial statements.

Where to Go From Here?

On November 15th, 2013, I met with Bram Freedman, president of the Concordia Foundation, and Marc Gauthier, treasurer of Concordia University. We discussed the shortcomings in using the financial statements of the foundation to evaluate whether the Concordia Foundation invested in companies that were in line with Concordia University’s environmental policies. The Concordia Foundation president agreed to begin designing a socially responsible investment plan.

On Sunday, November 24th, 2013, Bram Freedman e-mailed the Concordia Student Union and Graduate Student Union requesting their participation in a Joint Responsible Investment Working Group. The group will consist of:

- 2 or 3 Board members from the Foundation

- 3 representatives of CSU/GSA/ASFA ( a total of 3)

- Erik Chevrier

- Bram Freedman

- Marc Gauthier (University Treasurer)

The Joint Responsible Investment Working Group will be meeting for the first time in January 2014.

Research Project from Here On

Until the Joint Responsible Investment Working Group meet in January, I will focus my research on socially responsible investments. I will identify which socially responsible investments can be applied to the Concordia Foundation and I will locate other institutions who have adopted similar socially responsible investment plans.

References

Galbraith J. K., (2001) The Affluent Society, Houghton Mifflin Company.

Marx, K.(1976), Capital Volume 1, Penguin Books Classics, New York Stanford, J., (2008)

Economics for Everyone: A Short Guide to the Economics of Capitalism, Fernwood Publishing

Footnotes